Hey! Should You Invest in Bitcoin?

Well, Cryptocurrency Lobbyists Just Reshaped U.S. Policy Winning Over Trump and Congress with Payoffs to Foster a Pro-Bitcoin Future and it has changed everything!

What just happened?

Bitcoin is a global digital asset and the USA is the largest economy in the world. Put the two together and you’ve got Digital Gold!

The USA now has a pro-Bitcoin President and Congress. Yes, Trump and over 269 members of Congress are now Pro-Bitcoin. So with the USA no longer pushing back and taking a pro-Bitcoin position, the digital asset has already risen from $ 68,000 to over $ 81,000 in just 6 days. And most experts say it will hit $ 100,000 by the time Trump takes office in January 2025.

Looking at the bigger picture, as global demand continues to grow and other countries are forced to compete with the USA and with a fixed supply built-in, the price is expected to surpass $ 1,000,000 in 10 years! This is a new era in Bitcoin folks!

But how did we get here? And what is going on? Inquiring minds want to know!

Well, over the last year, the walls started to crack open. Bitcoin EFT applications wallowed in line for years to get approvals in the USA. But early this year, it happened and gates opened up to ETFs.

Bitcoin ETFs are already on the stock exchange making Bitcoin more accessible to corporations, institutions, and individual investors. Among the many ETFs that were pioneers this year were the huge world-beaters Blackrock who operate iShares Bitcoin Trust ETF (IBIT). But there are so many others now ie…Grayscale Bitcoin Trust (GBTC), Invesco Galaxy Bitcoin ETF (BTCO), Bitwise Bitcoin ETF (BITB), ProShares Bitcoin Strategy ETF (BITO), Volatility Shares 2x Bitcoin ETF (BITX), ProShares Short Bitcoin ETF (BITI), Ark 21Shares Bitcoin ETF (ARKB) and more

Anyways, once that happened, it was game on.

The remaining hurdle was to get the USA to create a positive regulatory framework and provide clarity for investors. This would further pry open the gates and allow others into the game. And that’s about to happen.

Now, initially, U.S. leaders, President-elect Donald Trump, viewed Bitcoin with extreme suspicion and even outright hostility, associating it with crime, volatility, and a threat to the stability of the U.S. dollar.

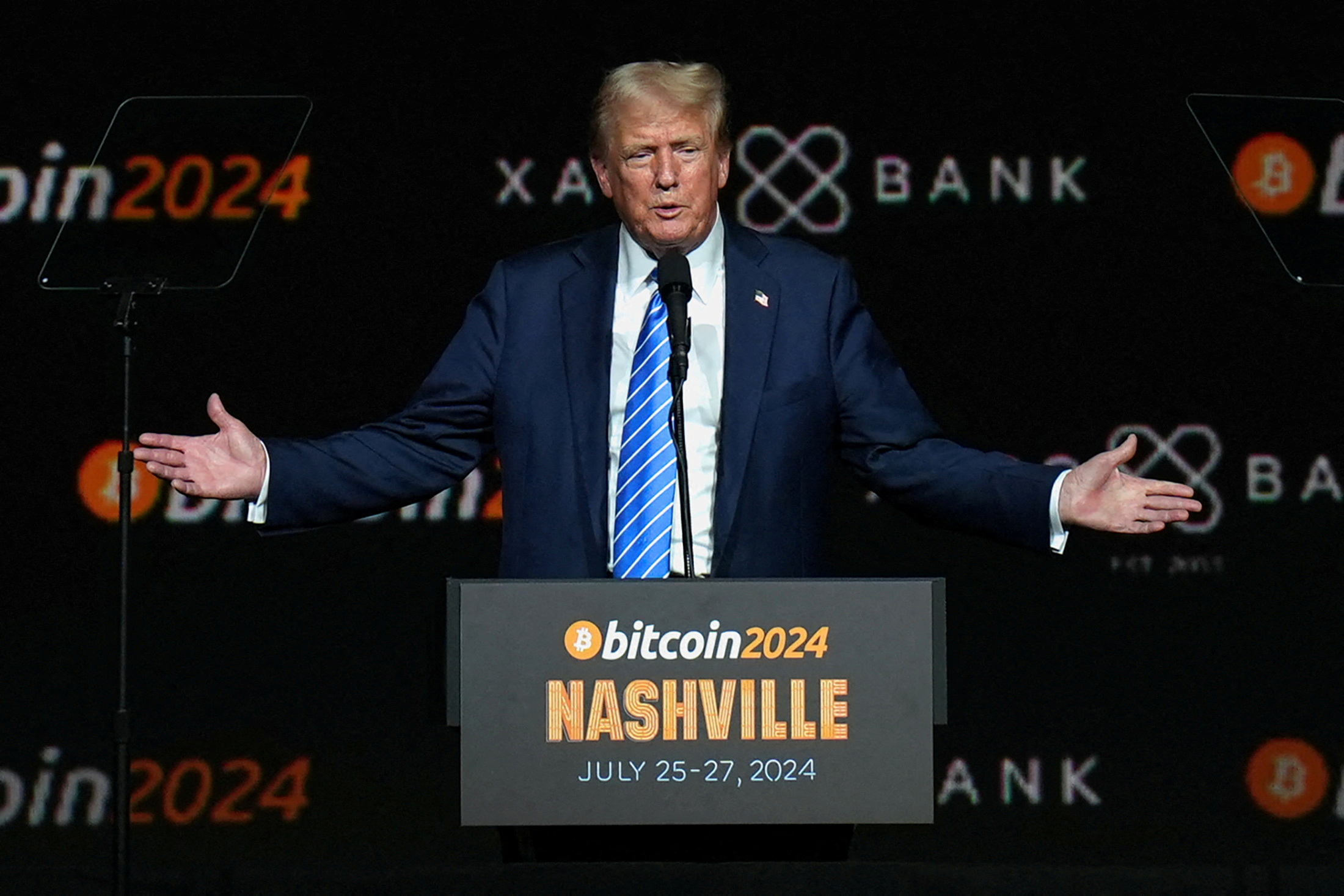

However, by 2024, the political landscape had shifted significantly to the point where now 269 members of Congress are pro-Bitcoin. And even former Anti-Bitcoiner Donald Trump is now being labeled The First US Bitcoin President.

WTF? Right? How did this happen?

Well, here’s a dive into how this shift occurred, focusing on key figures like Trump, Kamala Harris, and Congress.

1. The Anti-Bitcoin Beginnings: Donald Trump’s Initial Stance

In 2019, then-President Donald Trump made his position on Bitcoin abundantly clear through a now-famous tweet, where he stated,

“I am not a fan of Bitcoin and other Cryptocurrencies.”

Trump argued that cryptocurrencies could facilitate illegal activities and compete against the U.S. dollar, which he was determined to protect. His administration’s stance was similarly critical, with Treasury Secretary Steven Mnuchin and other senior officials voicing concerns and pushing for strict regulations.

The administration’s position was firm: Bitcoin and other digital assets represented instability, speculation, and a challenge to national security.

2. Lobbyists Move In: The Strategic Outreach to Trump

Despite Trump’s firm opposition, the cryptocurrency industry recognized that his influence could be swayed. Leading crypto lobbying groups, such as the Blockchain Association, Digital Currency Group (DCG), and the Crypto Council for Innovation, began extensive lobbying efforts to open up his camp to Bitcoin.

Key individuals, including Anthony Scaramucci—who had briefly served in Trump’s administration—and other high-profile cryptocurrency advocates, began aligning themselves with pro-Trump PACs and Republican political events.

Estimates suggest that Bitcoin lobbyists spent over $10 million to reach Trump and his inner circle. Some say it was as high as $ 75 million. This money was spent on campaign contributions, PAC donations, event sponsorships, and private meetings, with the aim of reshaping Trump’s stance on Bitcoin.

Their arguments centered on Bitcoin’s potential for financial freedom, reduced government intervention, and appeal among Trump’s conservative base, many of whom value personal financial autonomy.

By early 2024, Trump’s stance had noticeably softened. His rhetoric shifted to acknowledging the role Bitcoin could play in protecting wealth against inflation and decentralizing financial power.

He even began advocating for a lighter regulatory touch on Bitcoin, aligning himself with a broader conservative perspective on free markets and limited government.

3. Kamala Harris and the Democratic Outreach

As the cryptocurrency lobbyists made inroads with Trump, they also focused on gaining support from Democrats, including Vice President Kamala Harris.

While Harris was less publicly vocal about cryptocurrency, her role as a key Democratic leader made her an attractive target for the industry. Bitcoin advocates hoped that by building support within both parties, they could secure long-term bipartisan support for pro-crypto legislation.

Lobbying efforts targeting Harris and other Democrats included substantial contributions to Democratic-aligned PACs, campaign donations, and event sponsorships. Through these channels, Bitcoin lobbyists allocated an estimated $3 million to $7 million to influence Harris’s campaign and gain her attention on cryptocurrency issues.

Although Harris had not expressed as strong a pro-Bitcoin stance as Trump, her willingness to engage with cryptocurrency advocates reflects the lobbying campaign’s success. These efforts helped keep the cryptocurrency conversation active in Democratic circles, contributing to a more balanced and bipartisan stance on digital assets.

In short, no matter who won the election, Bitcoin was going to win the future!

4. Winning Over Congress: The Influence on Over 260 Members

Perhaps the most significant outcome of the Bitcoin lobbyists’ efforts is the support of over 260 members of Congress for pro-Bitcoin policies. This transformation was a coordinated and long-term project, involving millions in lobbying funds distributed across the legislative branch. Lobbyists engaged with Congress by targeting key committees, such as the House Financial Services Committee and the Senate Banking Committee, which play central roles in shaping financial policy.

The lobbying funds were spent on various strategies, including:

- Direct Donations to Campaigns: Contributions from cryptocurrency advocates were strategically made to campaigns of Congress members who were open to the idea of financial innovation and cryptocurrency regulation reform.

- Educational Initiatives: Bitcoin lobbyists organized seminars, briefings, and private events to educate lawmakers on the benefits of Bitcoin, framing it as a path to financial freedom and innovation.

- Bipartisan Sponsorships: By funding PACs and supporting congressional events, lobbyists ensured that pro-Bitcoin discourse reached both Democratic and Republican lawmakers.

The result?

269 members of Congress now support pro-Bitcoin initiatives, marking a monumental shift in legislative attitudes. This bipartisan coalition has introduced and advocated for legislation aimed at providing regulatory clarity for Bitcoin, reducing barriers to entry for cryptocurrency businesses, and fostering innovation within the U.S. cryptocurrency market.

5. The Long-Term Impact: A Pro-Bitcoin USA

The success of Bitcoin lobbyists in transforming U.S. policy represents a new era for cryptocurrency. By securing high-profile advocates like Trump, creating dialogue within Democratic circles, and winning the support of a sizable portion of Congress, the Bitcoin lobby has reshaped the United States’ regulatory outlook on digital assets. This shift indicates a pro-Bitcoin future in the U.S., with significant implications:

- Greater Regulatory Clarity: The push from Congress means that clearer regulations are likely to be implemented, providing stability and security for Bitcoin investors and businesses.

- Mainstream Adoption: With growing support from influential political figures, Bitcoin is likely to gain more mainstream acceptance, with new policies encouraging integration across financial sectors.

- Bipartisan Momentum: The successful courting of both Republicans and Democrats ensures that Bitcoin policy will likely retain support regardless of future election outcomes, securing a degree of stability for the cryptocurrency industry.

Conclusion

The evolution of the United States from an anti-Bitcoin to a pro-Bitcoin stance is a testament to the influence of well-coordinated lobbying. Bitcoin advocates poured millions of dollars into influencing political leaders across the board, from former President Donald Trump to Vice President Kamala Harris and over 260 members of Congress.

This outreach has fostered a more favorable environment for Bitcoin within the U.S., opening doors for broader adoption, innovation, and investment.

By aligning Bitcoin with ideals of financial freedom, decentralization, and limited government oversight, lobbyists successfully bridged the political divide, marking a new chapter for cryptocurrency in the United States.

Through these efforts, the Bitcoin industry has not only reshaped U.S. policy but has also cemented its role in the future of global finance.

Finally, there is talk the USA will acquire another 1,000,000 Bitcoin over 5 years to add to its already $ 13 Billion worth on hand officially creating a strategic reserve. If that happens, the world of money has completely changed and we are now living in a new world folks! So Stay Tuned.

Sources

Coach J.P. Money is the founder of Coach J.P. Money. He is an expert in Coaching and Money! He is also a writer, global citizen eco-activist, visionary, musician, artist, entertainer, businessman, investor, life coach, and syndicated columnist. He is also known as the music artist “Johnny Punish”; a name given to him by a bandmate during his Punk Rock years fronting the rogue underground punk band “Twisted Nixon”

His Expat home base since the late 1990s is Mexico. J.P. Money, aka Charles Bivona Jr., was educated at the University of Nevada Las Vegas (1980-81) and California State University Fullerton (1981-1984) with studies in accounting, finance and business. He bought is first real estate income property at 17 years old with no money down. He has been debt-free and building wealth since 1998.

Before the “internets” had been invented, he also owned and ran (5) national newspapers in the United States of America from 1987-1998. In addition, he created and ran the important online media sites; HireVeterans.com (2004-2020) and VT Foreign Policy (2004-2023).

J.P. Money is married to Queen Albertina from Sinaloa Mexico (1985). Together they have 3 adult children and 7 grandkids. They live in Baja Mexico at the home they built together out of plastic bags and dirt (Super Adobe). Now they share their epic artistic piece with the world as a unique luxury BnB called “Hacienda Eco-Domes“.

Read J.P. Money’s Full Bio at PunishStudios.com >>>